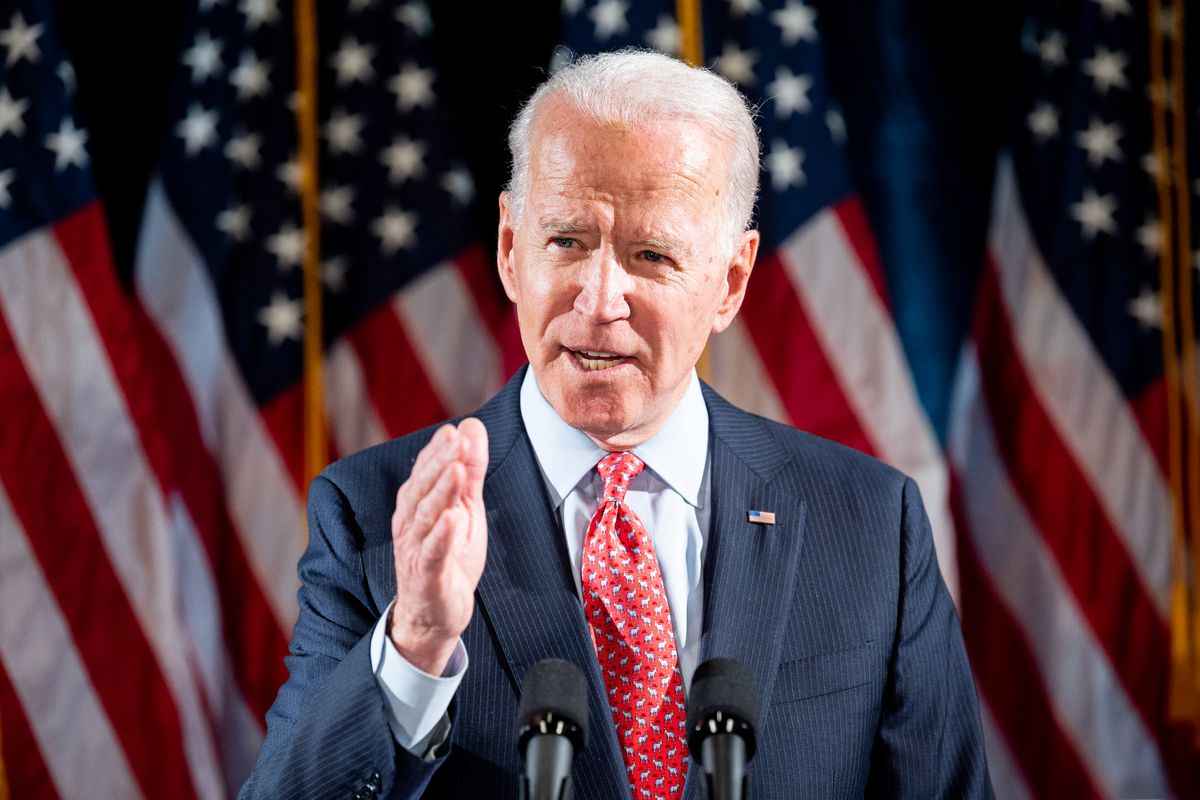

Biden’s “agency transition teams,” named in a statement here on Tuesday afternoon, are tasked with liaising with the outgoing Donald Trump administration for a smooth transition.

The names on the list will not necessarily join the new administration, although some may. They “reflect the values and priorities of the incoming administration,” the statement said.

Experts on economics, the Federal Reserve and Treasury Department include familiar names from the Democrats’ deep bench of former Barack Obama administration officials to emerging voices who have argued that the U.S. government should do more to reduce inequality.

Mehrsa Baradaran, for example, who is working on the Treasury team, has argued the Fed should play a more aggressive role in establishing bank accounts for every family as way to ensure access to the financial system.

The list reflects union influence, and possible use of the federal purse to boost economic growth through targeted investment.

Massachusetts Institute of Technology’s Simon Johnson, also on the Treasury team, for example, has argued that a core U.S. problem is the lack of public investment in basic research, and suggested funding research institutions in middle-sized cities.

Another Treasury team pick, Nancy Lee, has written extensively on sustainable development finance and the role of private finance.

KeyBank NA executive Don Graves, tapped to work on a broader economic agency review, is one of the few bankers on the list. Before joining KeyBank in 2017, where he headed corporate responsibility and community relations, Graves worked in the Obama administration as Biden’s director of domestic and economic policy.

Experts tapped for the U.S. Trade Representative’s office show strong union interests, including AFL-CIO campaign leaders Julie Greene and former AFL-CIO trade official Celeste Drake.

Drake, now at the Director’s Guild, advised USTR during Trump’s renegotiation of the North American Free Trade Agreement. Team leader Jason Miller, former deputy director of the White House Economic Council under Obama, worked on efforts to boost U.S. manufacturing jobs.

The list includes Riley Ohlson, head of federal affairs at the Alliance for American Manufacturing, a domestic industries group spearheaded by the United Steelworkers and Todd Tucker, a Roosevelt Institute scholar.

Notable advisers to the banking and markets regulatory team include its lead, Gary Gensler, who served as chair of the Commodity Futures Trading Commission (CFTC) from 2009 to 2014 and oversaw the implementation of key reforms following the 2009 financial crisis; and Andy Green, managing director of Economic Policy at liberal think tank the Center for American Progress.

Green is a widely respected regulatory expert who previously served as counsel to Kara Stein, a former commissioner of the U.S. Securities and Exchange Commission who was well-loved by progressives.

Also on the list: Amanda Fischer, policy director at think tank the Washington Center for Equitable Growth, who was previously an aide to progressive U.S. Representative Katie Porter and Dennis Kelleher, CEO of progressive think tank Better Markets and a vocal critic of Trump’s attempts to relax banking regulations.